Unless you’ve been living under a rock, you’re probably aware that college is expensive. So, if the grand plan includes seeing your little-one at university or college, the sooner you can start squirreling funds away for it, the better – Welcome the 529 Savings Plan.

But first…. How much does it cost to send your kids to college?

Our friends over at NerdWallet have published a fantastic article titled: Experienced Mothers to Expectant Moms: Start Saving for College Now

One of the many interesting tidbits of information is:

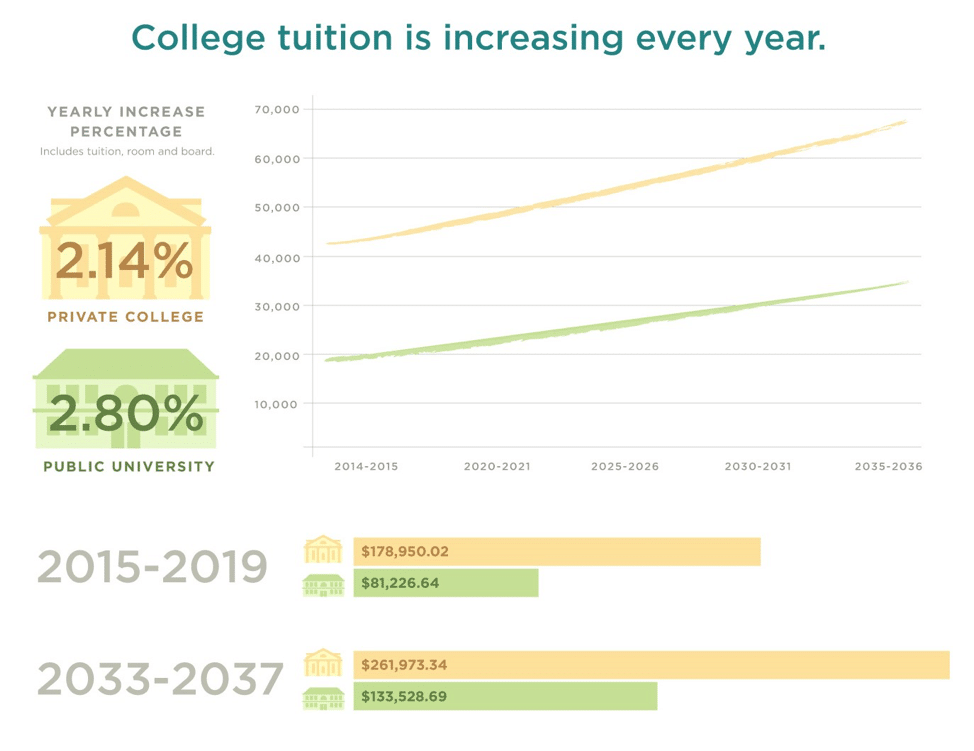

Over the last decade, the average published tuition and fees at public, four-year schools have risen a whopping 42%, adjusted for inflation, according to the College Board (PDF), a private association that includes more than 6,000 colleges, universities and schools.

The more you think about it, the earlier you start saving, the less impact there will be on Family income.

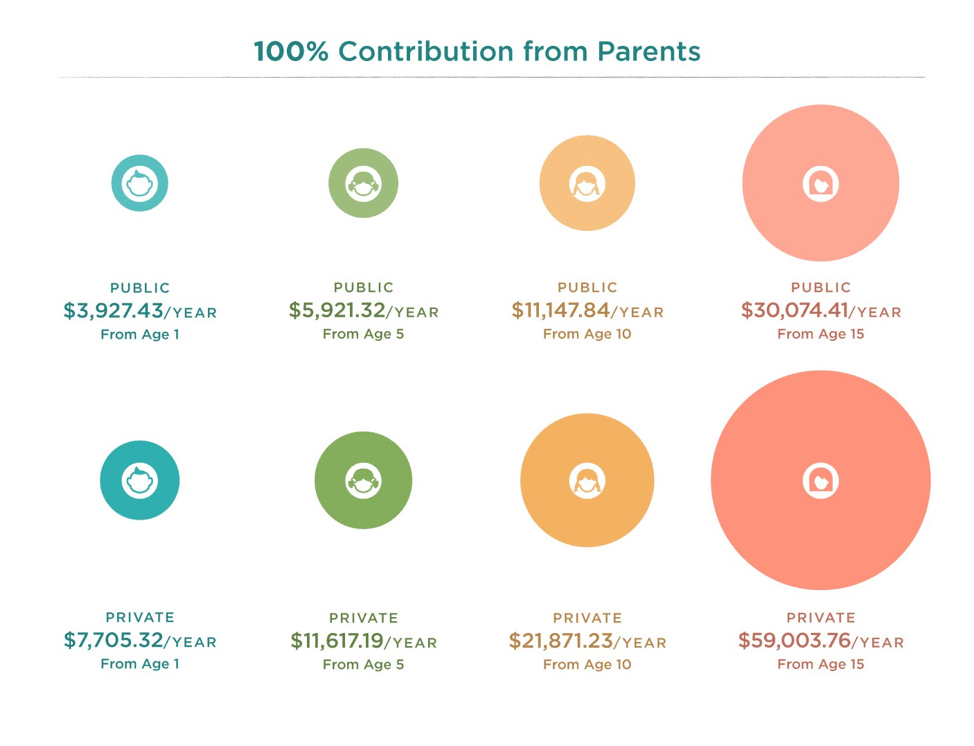

Here’s a graphic from the same NerdWallet article above that is pretty self-explanatory:

How a 529 Plan Works

Basically, a 529 plan is a college savings account that's exempt from federal taxes.

These plans, named for Section 529 of the federal tax code, additionally have tax benefits at state level, in some states, for in-state residents.

529 funds can be used towards most accredited colleges and graduate schools, including professional and trade schools. Foreign schools with attending students who receive federal financial aid also qualify. Contributions apply to a variety of qualified educational expenses, including tuition, books and room and board for those attending at least half time.

There are two types of 529 plans - Prepaid and Savings.

Prepaid are exactly how they sound – if you open a prepaid tuition plan, you can lock in the current costs of tuition in place of future prices, which generally rise every year. There are pro’s & con’s to this plan, but if locking in current tertiary tuitions appeals, then a great source of information on these plans can be found here.

The Savings Plan is exactly that; an account that is capital gains tax exempt where most expenses associated with tertiary education can be paid with these funds.

College savings investment plans have grown in popularity during the past few years, while several prepaid tuition plans have stopped accepting new enrollees or shut down entirely. The decreased popularity of prepaid plans may be due in part to some particular drawbacks. For example, money put into a state-run prepaid plan may only be applied to tuition and fees at in-state public colleges and universities. Room, board, books and other expenses aren't included and must be covered separately.

Why not just save for college in a standard old savings account? For one, interest rates. Have you had a look at your bank’s savings account rates lately? Don’t expect much in the way of growth over the ensuing years.

By far the biggest perk of a 529 plan is the tax advantage (see above). The money you earn from investing in the plan isn’t federally taxed and as the IRS explains, “generally not subject to state tax when used for the qualified education expenses of the designated beneficiary, such as tuition, fees, books, as well as room and board,”.

This means your money can grow tax-free. However, contributions to a 529 plan aren’t deductible in California. This basically means you can’t deduct the amount you save in a 529 from your taxable income, the way you can with, say, a 401(k) or a traditional Individual Retirement Account. But this also means that when you take money out of the 529 plan, you don’t have to pay taxes.

Since 529 plans are state-sponsored, you don’t set them up the same way you would other investment accounts. Almost all states have totally different 529 plans and some states have a few options to choose from.

The Wall Street Journal further explains:

“Each state picks a single administrator, like Vanguard, to run its plan and handle accounts for investors. These investment managers become, in effect, the brokerage firm for your college savings money. If you want to invest with the plan in your state, you have to work through the state’s administrator. You don’t have to invest in your state’s plan, however—you can invest in any state’s plan. But in general, you can a better income-tax deduction by contributing to your own state’s plan.”

You can also work with a financial advisor to choose a plan. You’ll pay for the service, of course, but some people prefer the convenience of having someone else figure it all out for them. If you’re already working with an advisor, this might be an easier option.

Most 529 investment plans then come with their own options: age-based plans or custom plans.

- With a custom plan, you choose how to divvy up your own assets (specific types of investments).

- With an age-based plan, your investment portfolio changes on its own as the beneficiary of the plan (your kid, grandkid, whomever) gets closer to college-age.

Anything Else I Should Know?

Those are the basics, but there are a few other things you should know. For one, there are limits to how much you can contribute. The IRS defines the limits as: “contributions cannot exceed the amount necessary to provide for the qualified education expenses of the beneficiary.” Sounds pretty vague, right? It is, as insurance firm AXA points out (emphasis ours):

To qualify as a 529 plan under federal rules, a state program must not accept contributions in excess of the anticipated cost of a beneficiary’s qualified education expenses. At one time, this meant five years of tuition, fees, and room and board at the costliest college under the plan, pursuant to the federal government’s “safe harbor” guideline. Now, however, states are interpreting this guideline more broadly, revising their limits to reflect the cost of attending the most expensive schools in the country and including the cost of graduate school. As a result, most states have contribution limits of $300,000 and up (and most states will raise their limits each year to keep up with rising college costs).

Maybe more notable is the gift tax consequence. As the IRS explains, if your yearly contribution to the 529 plan (along with any other gifts) exceeds $14,000, you might have to pay a gift tax. (There is a way around this, though, which we’ve covered here.)

Also, it’s pretty easy to change the beneficiary on your 529 plan. If your kid gets a scholarship and doesn’t need all the money you’ve invested over the years, you could easily change the beneficiary to a sibling. Or you could just withdraw the money, as Fidelity explains:

“If the beneficiary receives a scholarship or attends a U.S. military academy, the scholarship amount or cost of attendance can be withdrawn from the 529 plan account and the 10% federal penalty tax does not apply.”

The big caveat with this, however, is that the earnings are “subject to any other applicable taxes, including federal income tax,” so you will lose that sweet tax benefit, and as with all tax related programs, it’s best to check with your tax advisor as to the best implementation.

ALSO… be on the lookout for our blog on what ScuttleBugs has planned for our families. We believe it’s a first, and just another reason to consider ScuttleBugs your second home.